Income & Retirement Planning

Income & Retirement Planning

Retirement may seem be years off—or it might be just around the corner. No matter where you are on your career path, having a financial plan in place is essential to ensure you have the continued income to maintain your lifestyle and achieve your goals for your post-work years.

A Retirement Plan for You

Whether you have a set date to retire completely, hope to ease into retirement by reducing your work responsibilities, or wish to set foot on a new career path, we can work with you to design a plan to achieve your income requirements. During our retirement and income consulting process, we’ll start by reviewing your financial resources including investments, pensions, and social security benefits, considering your estimated future living expenses. Then we’ll work together to develop a diversified strategy for getting the most out of your financial assets.

Tax Planning to Preserve Your Wealth

At Cogent Private Wealth, we know that effective tax planning is crucial for building and safeguarding your nest egg. From minimizing out-of-pocket costs to ensuring that your legacy remains intact for the next generation, we will take the time to analyze tax impacts, finding the right products and strategies to reduce your tax liability and leave more for you and your family.

Plan Your Prosperous Retirement Journey with Us

Looking for expert assistance in creating a financial plan to meet your retirement goals? Whether you’re an individual or a business, our skilled team of retirement consultants can help. With unique income and investment planning tools and a customer-focused approach, we’ll work with you to find your path to a prosperous retirement.

Make an appointment with a planner today to see what we can do for you.

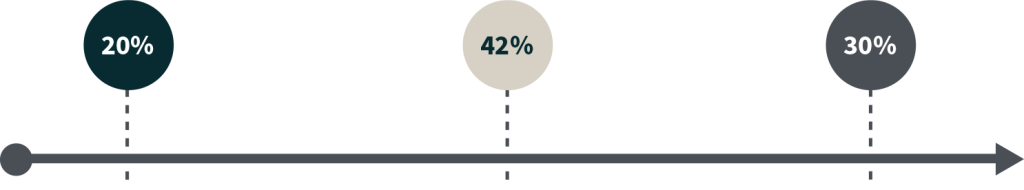

Create a plan to generate income

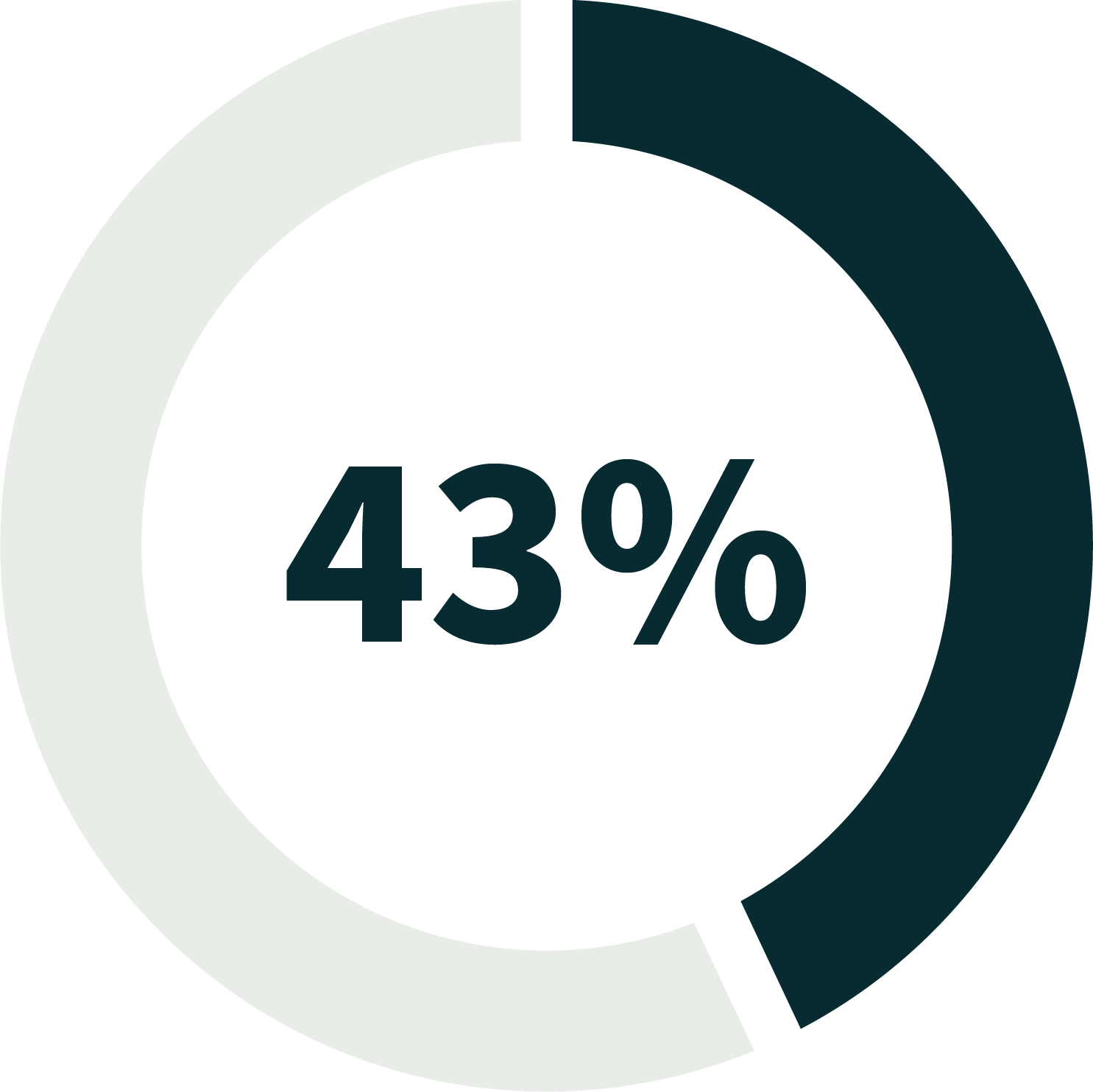

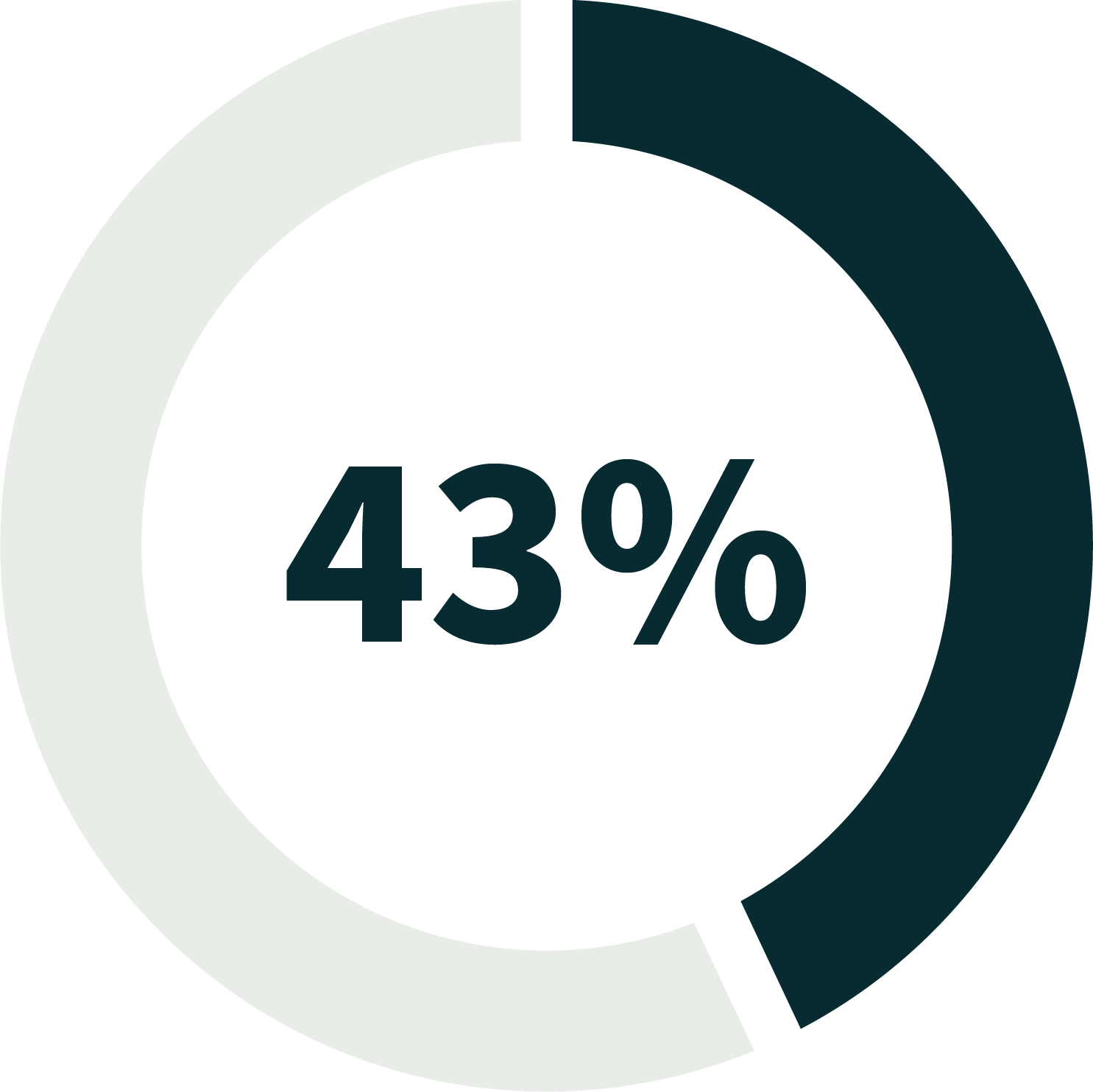

43% of full-service wealth management clients do not have a financial plan.

Source: J.D. Power 2023 U.S. Full-Service Investor Satisfaction Study