Tax Planning

Tax Planning

There’s more to wealth planning than saving and investing—building and transferring wealth can have major tax implications that can minimize the value of your portfolios and reduce the impact of your legacy for your heirs. Using advanced tax planning techniques to estimate your tax liability throughout various phases of your life, our financial professionals can help you choose financial strategies that help you keep as much of your money in your pocket as possible.

Strategies that Meet You Where You Are

Balancing today’s tax implications with tomorrow’s financial outlook can be a challenging and complex task. Whether you are at the peak of your career or enjoying a comfortable retirement, we can help you align your financial strategies—from investments to charitable giving—with your current needs, while considering the best ways to minimize future tax burdens. Our experts can assist you with:

- Estate tax planning

- Tax loss harvesting

- Philanthropic efforts

- Strategic business strategies

- Tax-advantaged accounts

A Proactive Approach

The best wealth preservation tax strategies are adaptable, evolving with the changing needs of the individual, as well as updates to tax law. Our planners take a proactive approach, regularly reviewing and adjusting your plan to ensure it accurately reflects both your financial picture and life stage as well as current and planned changes to state and federal tax code.

Optimize Your Wealth with Strategic Tax Planning

Our experienced planners can help you create a comprehensive tax strategy based on your current and projected financial picture that emphasizes, tax efficiency. With specialized knowledge in handling the complexities of tax implications for high-net-worth individuals, our effective tax management and minimization strategies can help preserve ensure that your wealth is preserved for years to come.

Make an appointment with a planner today to see what we can do for you.

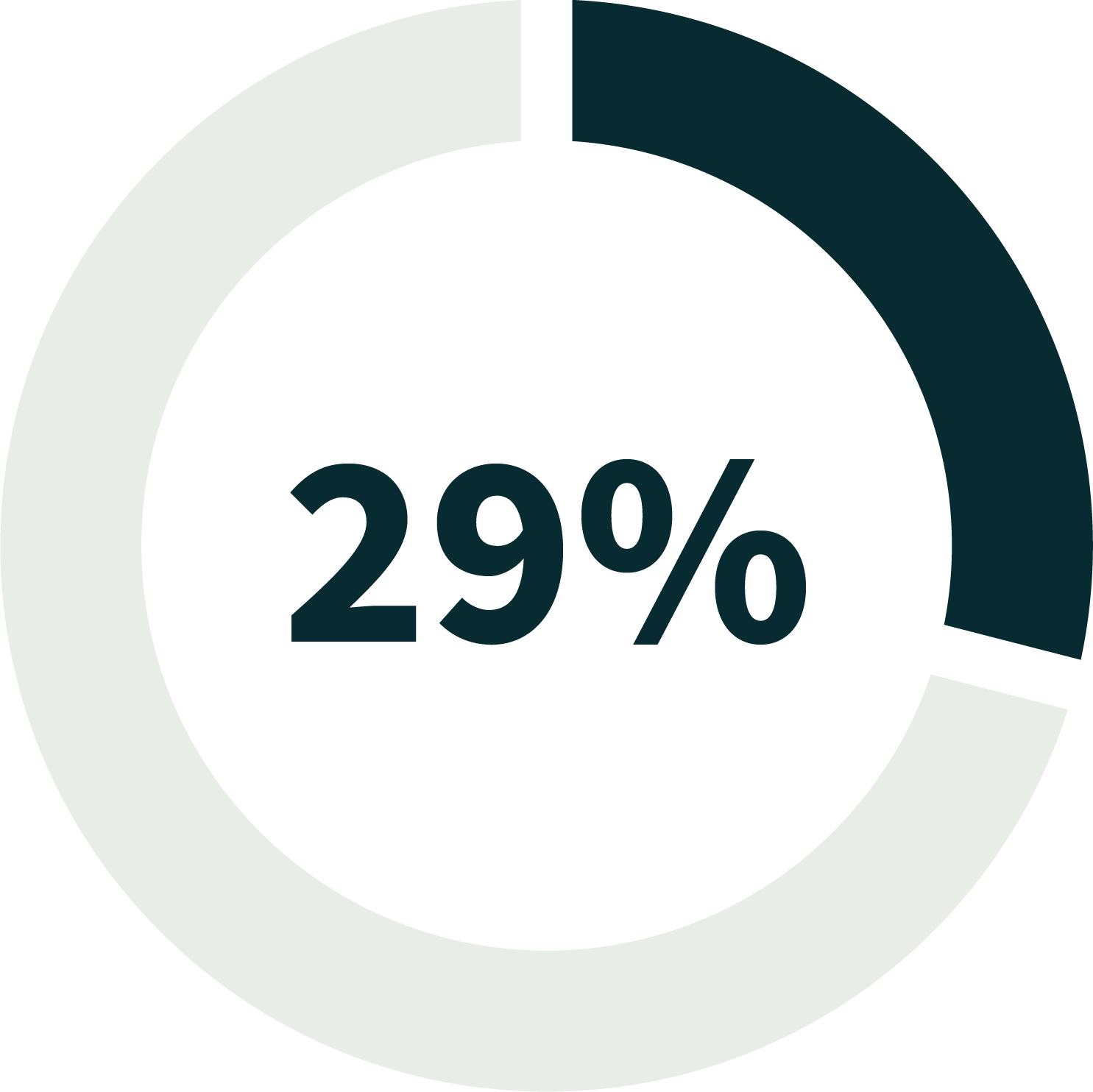

Design a Plan to keep as much of your money as possible

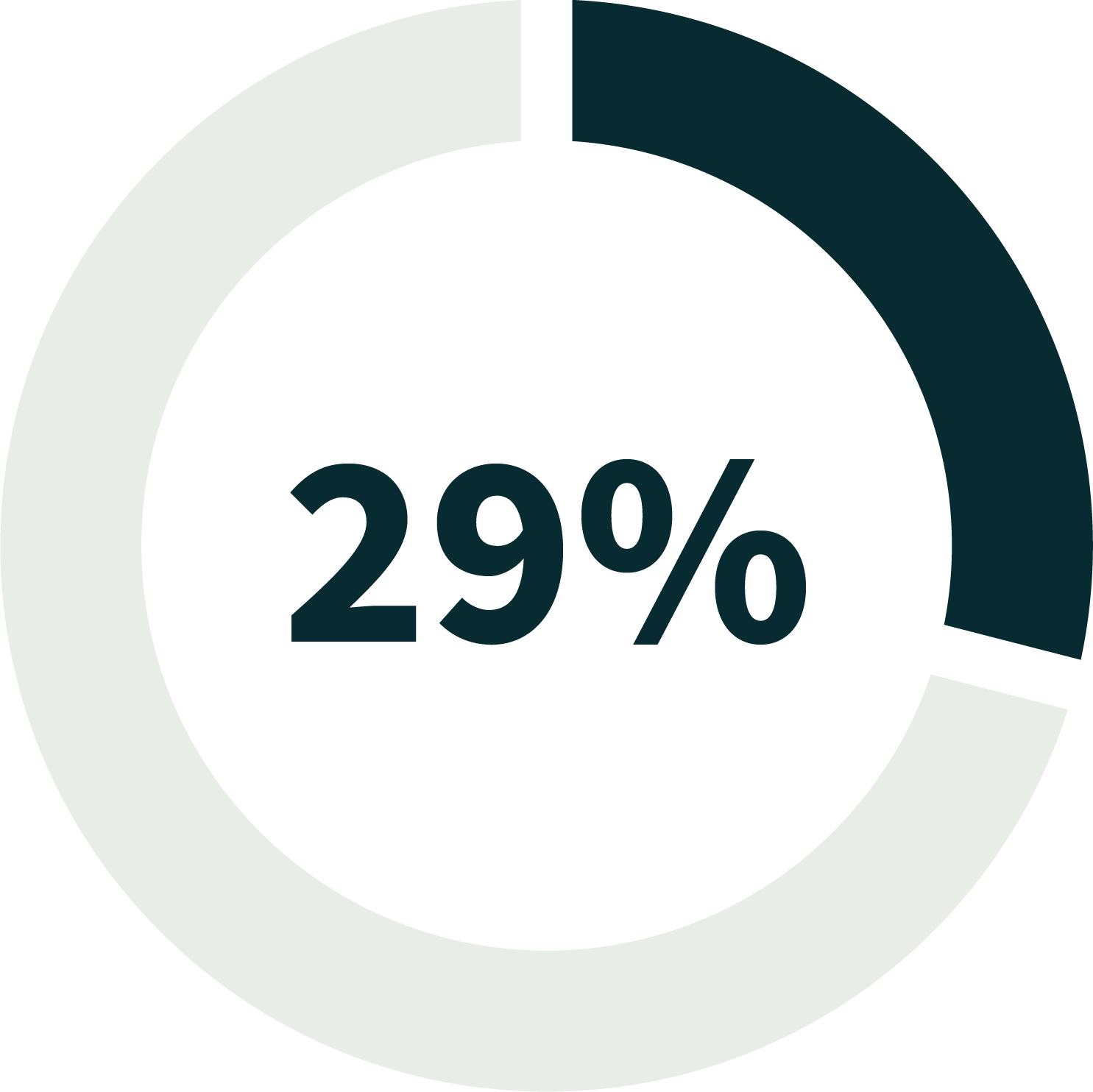

29% of Americans income is spent of their income on taxes.

Source: debt.org