Insurance

Insurance

Having adequate insurance protections can give you the peace of mind of knowing that if you, your business, or your family face a catastrophic event, your financial stability won’t be in jeopardy. With an assortment of commercial and individual options available in the marketplace, our planners can work with you and your agent to select plans that can shield you from the fallout of unforeseen circumstances and challenges. If you do not have a trusted insurance agent, we can assist you with filling that position on your team.

A Range of Options to Meet Your Needs

Our team of experts can offer valuable planning insights into a wide array of insurance options. Whether it’s protecting your assets, securing your health, or planning for the unexpected, we can help you find tailored solutions that address your unique needs and circumstances.

- Life Insurance: To ensure financial stability for your loved ones in the face of an untimely passing.

- Property Insurance: For homes and commercial real estate, to protect your property and valuables from theft, accidents, and natural disasters.

- Casualty Insurance: To safeguard your business from liability and protect against legal and financial repercussions.

The right insurance coverages can help create a resilient wealth for individuals, families, and businesses when navigating life’s uncertainties.

Proactive Planning

Insurance is an essential part of any financial plan, and an indispensable tool preserving your assets and your ongoing financial security. We will work with you to best understand your needs and anticipate potential risks. Once you have identified risks, a qualified insurance agent can help you effectively mitigate them.

Secure Your Future with Comprehensive Insurance Planning

Life is unpredictable—but with the right coverage you can seek to avoid the worst financial outcomes when facing an unforeseen catastrophic event. Our planners will take the time to analyze your insurance needs and work with an insurance professional to provide protections where you likely need them the most. And as your insurance requirements change, we’ll work with you to review your coverage, so it effectively reflects your evolving needs.

Make an appointment with a planner today to see what we can do for you.

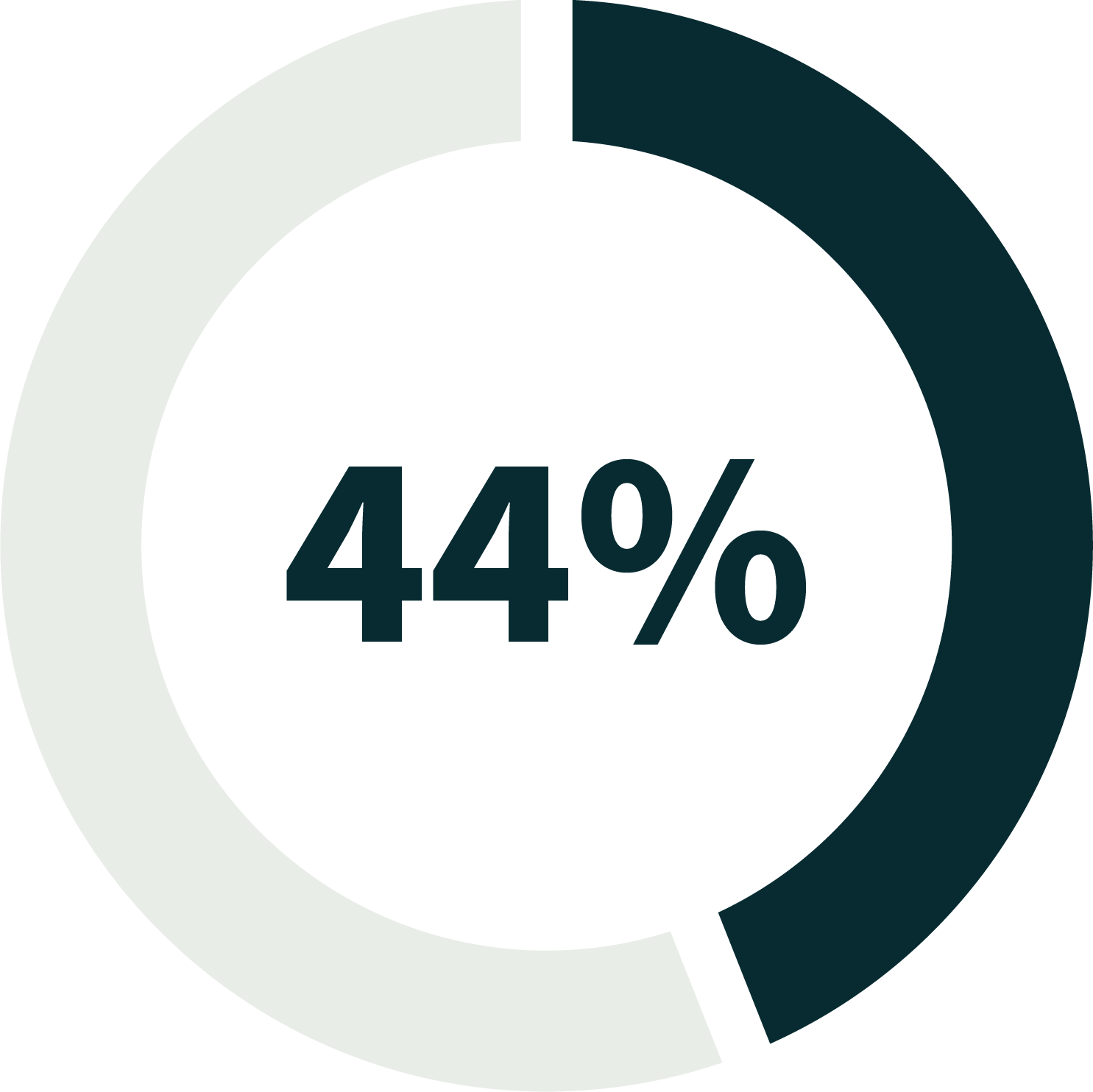

Plan for the unexpected

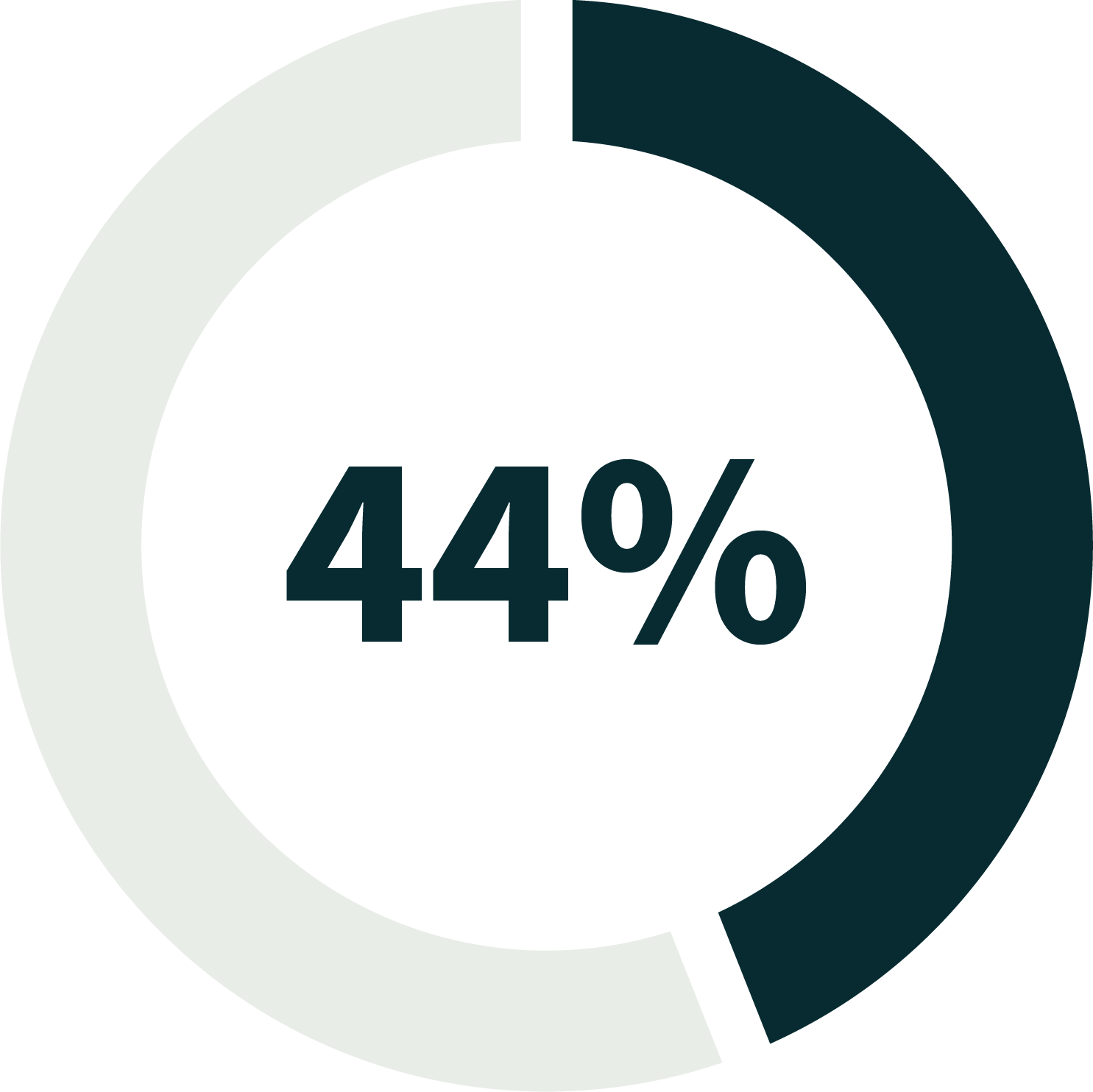

44% of American households would encounter significant financial difficulties within a year if they lost the primary wage earner in the family.

Source: Forbes